san francisco sales tax rate july 2021

And the SF Gross Receipts Tax Computation Worksheet to determine your San Francisco Gross Receipts Tax obligation. For 2021 Gross Receipts Tax rates vary depending on a business gross receipts and business activity.

Sales Gas Taxes Increasing In The Bay Area And California

San Francisco CA Sales Tax Rate.

. The minimum combined 2022 sales tax rate for San Francisco California is. More than 100 but less than or equal to 250000. California has the highest state-level sales tax rate at.

The raise was approved by California voters in the Nov. 2021 State Sales Tax Rates. How much is sales tax in San Francisco.

The San Francisco Tourism Improvement District sales tax has been changed within the last year. San Francisco County California Sales Tax Rate 2021 - Avalara San Francisco County California sales tax rate Home California San Francisco County San Francisco County Tax jurisdiction breakdown for 2022 California 6 San Francisco 025 San Francisco Co Local Tax Sl 1 San Francisco County District Tax Sp 138. Groceries and prescription drugs are exempt from the California sales tax.

The transfer tax rate is variable depending on the consideration paid purchase price OR the fair market value as shown in the chart below. 91 in Santa Clara County and. The current total local sales tax rate in San Francisco CA is 8625.

The new law directs the Department of Revenue to calculate reemployment assistance tax rates without respect to the effects of the pandemic and directs the revenue from the online sales tax to the Unemployment Compensation Trust Fund until the Fund reaches pre-pandemic levels ie 4071519600. California has 2558 special sales tax jurisdictions with local sales taxes in. You may either pay the entire tax when the first installment is due or pay in two installments.

2021 State Sales Tax Rates California has the highest state-level sales tax rate at 725 percent. It was raised 0125 from 975 to 9875 in July 2021. The California sales tax rate is currently.

The County sales tax rate is 025. The December 2020 total local sales tax rate was 8500. The secured property tax rate for Fiscal Year 2021-22 is 118248499.

Changes recommended by the Budget and Appropriations Committee to adjust spending in the budget. What is the sales tax rate in San Francisco California. This is the total of state county and city sales tax rates.

Learn how to read your secured property tax bill. The San Francisco sales tax rate is. The minimum combined sales tax rate for San Francisco California is 85.

The states rate is currently 725 with a base rate of 6 with a mandatory local additional rate of 125 that goes directly to city and county funds. Tax rate for entire value or consideration is. In San Francisco the tax rate will rise from 85 to 8625.

SAN FRANCISCO KRON Several Bay Area cities saw a Sales Use tax hike go into effect on April 1. Did South Dakota v. - The sales tax is increasing in more than a dozen Bay Area cities and counties.

Click here to find. Indiana Mississippi Rhode Island and Tennessee. Most of these tax changes were approved by voters in the November 2020.

It was raised 0125 from 85 to 8625 in July 2021 raised 0125 from 85 to 8625 in July 2021 raised 0125 from 925 to 9375 in July 2021 and raised 0125 from 85 to 8625 in July 2021. Board of Supervisors Committee fiscal years 2020-2021 and 2021-2022 spending plan September 22 2020. City of Union City.

New Sales and Use Tax Rates Operative July 1 2021 Created Date. California Department of Tax and Fee Administration Subject. City of San Leandro.

Economy The purpose of the Economy scorecard is to provide the public elected officials and City staff with a current snapshot of San Franciscos economy. Our GIS-based sales tax website allows the user to view sales tax receipts from calendar years 2017 to 2021 in. The lowest non-zero state-level sales tax is in Colorado which has a rate of 29 percent.

The California state sales tax rate is 75 and the average CA sales tax after local surtaxes is 844. San francisco and san jose both increased their sales taxes by 0125 percentage points to 8625 and 9375 percent respectively as a result of voter-approved measures while many other jurisdictions in the areaincluding the counties of alameda san mateo and santa claralikewise saw increases6sales taxes rose elsewhere in the state. Bay Area house sells.

5192021 120245 PM. The South San Francisco sales tax has been changed within the last year. L-805 New Sales and Use Tax Rates Operative July 1 2021 Author.

View our property tax resource guide Español Filipino 中文 to better understand how to navigate San Francisco property taxes. Ad Find Out Sales Tax Rates For Free. This scorecard presents timely information on economy-wide employment indicators real estate and tourism.

If entire value or consideration is. As of Thursday the sales tax is now more than 86 in San Francisco. The Board of Supervisors Budget and Appropriations Committees proposed legislation authorizing revenue and spending.

The December 2020 total local sales tax rate was 8500. Secured Property Tax bills are mailed in October. The California sales tax rate is currently 6.

Estimated business tax payments are due April 30th July 31st and October. 2 Four states tie for the second-highest statewide rate at 7 percent. 250 for each 500 or portion thereof.

Fast Easy Tax Solutions. San Francisco County CA Sales Tax Rate San Francisco County CA Sales Tax Rate The current total local sales tax rate in San Francisco County CA is 8625. Counties and cities can charge an additional local sales tax of up to 25 for a maximum possible combined sales tax of 10.

The County sales tax rate is. This is the total of state county and city sales tax rates. CA Sales Tax Rate.

The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025 county sales tax and a 225 special district sales tax used to fund transportation districts local attractions etc.

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

California Sales Tax Small Business Guide Truic

California City County Sales Use Tax Rates

States With Highest And Lowest Sales Tax Rates

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

Understanding California S Sales Tax

Which Cities And States Have The Highest Sales Tax Rates Taxjar

States With Highest And Lowest Sales Tax Rates

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

Understanding California S Sales Tax

Sales Tax By State Is Saas Taxable Taxjar

2022 Federal State Payroll Tax Rates For Employers

California Sales Use Tax Guide Avalara

California Sales Tax Rates By City County 2022

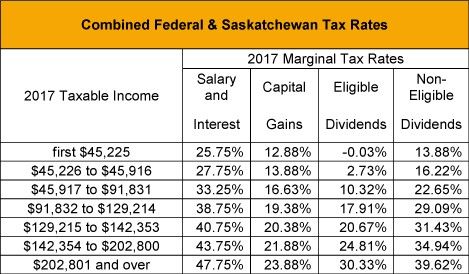

Saskatchewan 2017 Budget Sales Taxes Vat Gst Canada

Opinion Why California Worries Conservatives The New York Times

Understanding California S Sales Tax

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

California Localities Extend Tax Relief To Marijuana Companies In Absence Of State Action